Understanding Personal Loan Forgiveness: A Comprehensive Guide to Debt Relief Options

#### Personal Loan ForgivenessPersonal loan forgiveness refers to the process through which borrowers can have a portion or all of their personal loans canc……

#### Personal Loan Forgiveness

Personal loan forgiveness refers to the process through which borrowers can have a portion or all of their personal loans canceled or discharged. This can be a crucial relief option for individuals struggling with debt, particularly in times of financial hardship. Understanding the nuances of personal loan forgiveness can empower borrowers to make informed decisions about their finances and explore potential relief options.

#### What is Personal Loan Forgiveness?

Personal loan forgiveness is not as commonly discussed as forgiveness programs for student loans or mortgages, but it is an important aspect of personal finance. Essentially, personal loan forgiveness allows borrowers to eliminate their debt under certain conditions. This can occur through various means, such as negotiating with lenders, qualifying for specific debt relief programs, or through bankruptcy proceedings.

#### Eligibility for Personal Loan Forgiveness

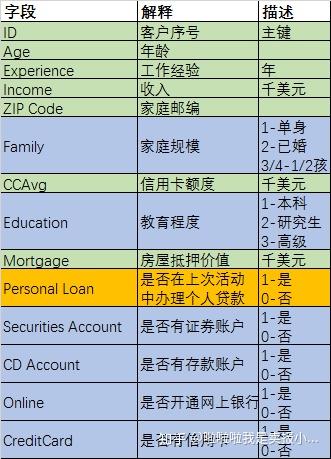

Not everyone qualifies for personal loan forgiveness, and eligibility can vary significantly based on the lender, the type of loan, and the borrower's financial situation. Some common factors that may influence eligibility include:

1. **Financial Hardship**: Borrowers must often demonstrate that they are experiencing significant financial difficulties that prevent them from repaying their loans.

2. **Loan Type**: Certain types of loans may have specific forgiveness options. For instance, personal loans from non-profit organizations or loans tied to specific programs may offer more flexibility.

3. **Negotiation with Lenders**: Sometimes, borrowers can negotiate directly with their lenders for a reduced payment plan or partial forgiveness of the loan.

4. **Bankruptcy**: In some cases, filing for bankruptcy may lead to the discharge of personal loans, although this can have long-term implications on a borrower's credit score.

#### How to Apply for Personal Loan Forgiveness

Applying for personal loan forgiveness typically involves several steps:

1. **Assess Your Financial Situation**: Before seeking forgiveness, evaluate your current financial status. Gather all relevant documents, including income statements, expenses, and loan agreements.

2. **Contact Your Lender**: Reach out to your lender to discuss your situation. Be honest about your financial difficulties and inquire about any available forgiveness programs.

3. **Research Debt Relief Options**: Look into other debt relief options, such as debt consolidation or credit counseling, which may complement personal loan forgiveness.

4. **Consider Professional Help**: If the process feels overwhelming, consider consulting with a financial advisor or debt relief agency that can assist you in navigating your options.

#### Alternatives to Personal Loan Forgiveness

If personal loan forgiveness is not an option, there are several alternatives that borrowers can explore:

1. **Debt Consolidation**: This involves combining multiple debts into a single loan with a lower interest rate, making it easier to manage payments.

2. **Credit Counseling**: Non-profit credit counseling agencies can help borrowers create a budget, negotiate with creditors, and develop a repayment plan.

3. **Debt Settlement**: This process involves negotiating with creditors to settle debts for less than what is owed, but it may negatively impact credit scores.

4. **Bankruptcy**: As a last resort, filing for bankruptcy can provide relief from overwhelming debt, including personal loans, but it has significant long-term effects on credit.

#### Conclusion

Personal loan forgiveness can be a beacon of hope for individuals facing financial challenges. While it may not be as widely recognized as other forms of debt forgiveness, understanding the options available can help borrowers navigate their financial landscape more effectively. By assessing eligibility, exploring alternatives, and seeking professional guidance, individuals can take proactive steps toward achieving financial stability and relief from burdensome debt.