Understanding the Benefits and Repayment Options for Student Federal Loans

Guide or Summary:Student Federal Loans are a crucial financial resource for many individuals seeking higher education in the United States. These loans are……

Guide or Summary:

#### Introduction to Student Federal Loans

Student Federal Loans are a crucial financial resource for many individuals seeking higher education in the United States. These loans are backed by the federal government, making them a popular choice among students due to their favorable terms and conditions compared to private loans. Understanding the intricacies of student federal loans can empower borrowers to make informed decisions about their education financing.

#### Types of Student Federal Loans

There are several types of student federal loans available, each designed to meet different needs. The most common include:

1. **Direct Subsidized Loans**: These are need-based loans for undergraduate students. The government pays the interest while the student is in school, during the grace period, and during deferment periods.

2. **Direct Unsubsidized Loans**: Available to undergraduate and graduate students, these loans are not based on financial need. Interest accrues while the student is in school, which can increase the total repayment amount.

3. **Direct PLUS Loans**: These loans are available for graduate or professional students and parents of dependent undergraduate students. They can cover the full cost of attendance minus any other financial aid received.

4. **Direct Consolidation Loans**: This option allows borrowers to combine multiple federal student loans into a single loan, simplifying the repayment process.

#### Benefits of Student Federal Loans

One of the key advantages of student federal loans is the lower interest rates compared to private loans. Additionally, federal loans offer flexible repayment plans, including income-driven repayment options that adjust monthly payments based on the borrower’s income.

Moreover, federal loans provide various forgiveness programs, such as Public Service Loan Forgiveness (PSLF), which can forgive the remaining balance after a certain number of qualifying payments while working in a public service job.

#### Repayment Options for Student Federal Loans

Repaying student federal loans can seem daunting, but there are multiple options available to help borrowers manage their payments effectively.

1. **Standard Repayment Plan**: This plan has fixed monthly payments over a 10-year period, making it the quickest way to pay off loans.

2. **Graduated Repayment Plan**: Payments start lower and gradually increase, which can be beneficial for those expecting to earn more in the future.

3. **Extended Repayment Plan**: This plan allows borrowers to extend their repayment period up to 25 years, reducing monthly payments but increasing the total interest paid.

4. **Income-Driven Repayment Plans**: These plans, including Income-Based Repayment (IBR) and Pay As You Earn (PAYE), cap monthly payments at a percentage of the borrower’s discretionary income, with forgiveness available after 20 or 25 years of qualifying payments.

#### Conclusion

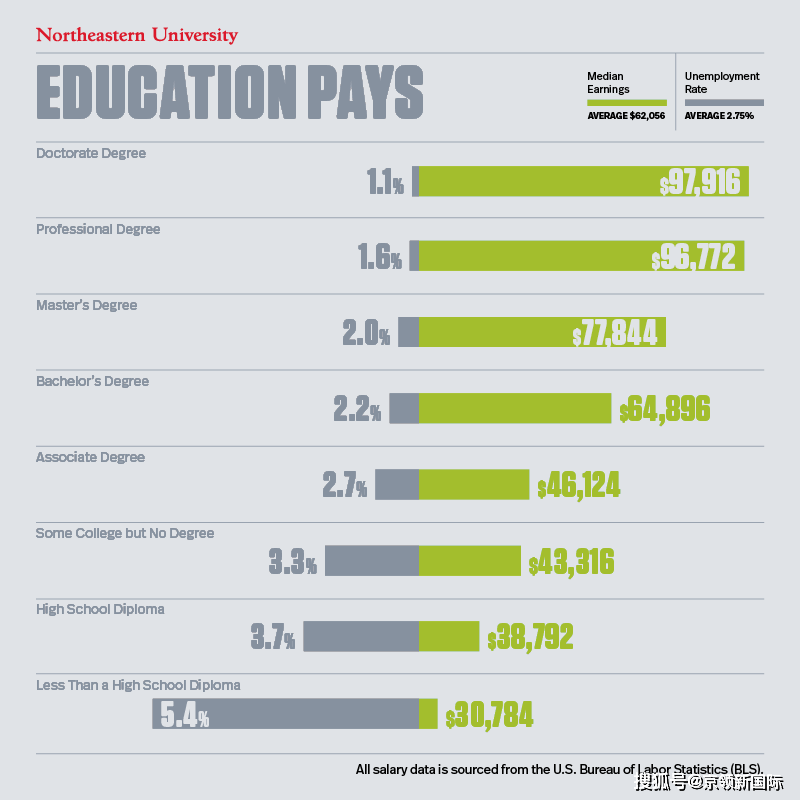

Navigating the world of student federal loans requires careful consideration of the types of loans available, their benefits, and the various repayment options. By understanding these aspects, students can make educated choices that align with their financial situations and future goals. With the right information and planning, student federal loans can be a powerful tool in achieving educational aspirations without overwhelming debt.