Understanding Flagged PPP Loans: What They Mean for Borrowers and Lenders

#### Introduction to Flagged PPP LoansThe Paycheck Protection Program (PPP) was designed to provide financial support to small businesses during the COVID-1……

#### Introduction to Flagged PPP Loans

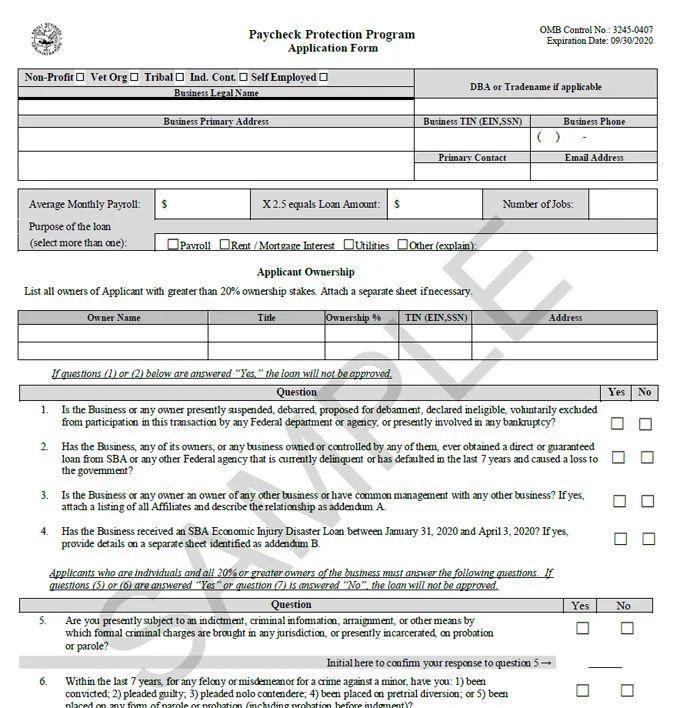

The Paycheck Protection Program (PPP) was designed to provide financial support to small businesses during the COVID-19 pandemic. However, not all loans issued under this program are created equal. Some loans have been "flagged," indicating potential issues that borrowers and lenders need to be aware of. In this article, we will explore what flagged PPP loans are, the reasons behind the flagging, and the implications for both borrowers and lenders.

#### What Are Flagged PPP Loans?

Flagged PPP loans refer to loans that have raised red flags during the review process. These flags can be due to discrepancies in the application, potential fraud, or failure to meet the eligibility criteria set forth by the Small Business Administration (SBA). When a loan is flagged, it does not necessarily mean it is ineligible; however, it does require further scrutiny.

#### Reasons for Flagging PPP Loans

There are several reasons why a PPP loan may be flagged. Some common reasons include:

1. **Inaccurate Information**: If the information provided in the loan application does not match up with the applicant's financial records, the loan may be flagged for further investigation.

2. **Eligibility Issues**: Borrowers must meet specific criteria to qualify for a PPP loan. If there are any doubts about a borrower's eligibility, the loan may be flagged.

3. **Fraudulent Activity**: The SBA has been vigilant in identifying fraudulent applications. If there are indications of fraudulent activity, such as inflated payroll figures or misrepresentation of business operations, the loan will be flagged.

4. **Loan Size Discrepancies**: If the loan amount requested appears disproportionately large compared to the borrower's payroll expenses or business size, it may trigger a flag.

#### Implications for Borrowers

For borrowers, having a flagged PPP loan can lead to several consequences. First and foremost, it may delay the disbursement of funds. Borrowers with flagged loans may face additional scrutiny from the lender or the SBA, which could result in a longer waiting period for loan approval.

Moreover, if a flagged loan is ultimately deemed ineligible, borrowers may be required to repay the funds received. This could create significant financial strain for businesses already struggling due to the pandemic. Additionally, a flagged loan may impact a borrower's creditworthiness, making it more challenging to secure future financing.

#### Implications for Lenders

Lenders also face challenges when dealing with flagged PPP loans. They must conduct thorough due diligence to ensure compliance with SBA regulations. This means investing time and resources into reviewing flagged applications and determining the legitimacy of the claims made by borrowers.

Furthermore, lenders may face reputational risks if they inadvertently approve loans that are later found to be fraudulent or ineligible. This could lead to increased scrutiny from regulatory bodies and potential financial penalties.

#### Conclusion

Flagged PPP loans represent a critical aspect of the Paycheck Protection Program that both borrowers and lenders must navigate carefully. Understanding the reasons behind the flagging and the implications for all parties involved is essential for maintaining compliance and ensuring the program's integrity. As the landscape of small business financing continues to evolve, staying informed about flagged PPP loans will be crucial for those looking to secure financial support in challenging times.

By being proactive and transparent in the application process, borrowers can minimize the risk of their loans being flagged, while lenders can uphold the integrity of the PPP and support businesses in their recovery efforts.