Understanding the Interest Rate on Debt Consolidation Loans: How to Choose the Best Option for Your Financial Health

#### Interest Rate on Debt Consolidation LoansWhen considering debt consolidation, one of the most critical factors to evaluate is the **interest rate on de……

#### Interest Rate on Debt Consolidation Loans

When considering debt consolidation, one of the most critical factors to evaluate is the **interest rate on debt consolidation loans**. This rate can significantly impact your overall financial health and the effectiveness of the consolidation strategy. Understanding how these rates work and what influences them can help you make informed decisions that benefit your financial future.

Debt consolidation loans allow individuals to combine multiple debts into a single loan, often with a lower interest rate than the average of their existing debts. This process can simplify payments and potentially reduce the total amount of interest paid over time. However, not all debt consolidation loans are created equal, and the interest rate is a pivotal aspect to consider.

#### Factors Influencing Interest Rates

The **interest rate on debt consolidation loans** can vary based on several factors:

1. **Credit Score**: Lenders typically assess your creditworthiness before offering a loan. A higher credit score may qualify you for lower interest rates, while a lower score could lead to higher rates or even loan denial.

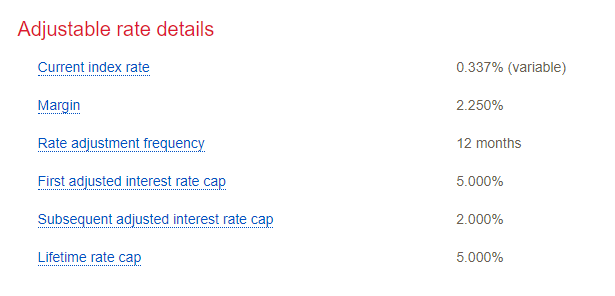

2. **Type of Loan**: Secured loans, which require collateral, generally have lower interest rates compared to unsecured loans. However, the risk of losing your collateral in case of default is a significant consideration.

3. **Loan Amount and Term**: The size of the loan and the repayment period can also affect the interest rate. Larger loans or longer terms might come with higher rates, depending on the lender's policies.

4. **Market Conditions**: Economic factors, such as inflation and the central bank's interest rate decisions, can influence the rates offered by lenders. Staying informed about economic trends can help you time your consolidation effectively.

#### Finding the Best Interest Rate

To secure the best **interest rate on debt consolidation loans**, consider the following strategies:

1. **Shop Around**: Different lenders offer varying rates and terms. Compare multiple options, including banks, credit unions, and online lenders.

2. **Negotiate**: Don’t hesitate to negotiate with lenders. If you have a good credit score or a long-standing relationship with a bank, you may have leverage to secure a better rate.

3. **Consider a Co-signer**: If your credit is not strong, having a co-signer with better credit can help you qualify for lower rates.

4. **Improve Your Credit Score**: Before applying for a consolidation loan, take steps to improve your credit score. Pay down existing debts, make timely payments, and avoid taking on new debt.

#### Conclusion

The **interest rate on debt consolidation loans** is a crucial element that can determine the success of your debt management strategy. By understanding the factors that influence these rates and actively seeking the best options, you can potentially save money and simplify your financial obligations. Always conduct thorough research, assess your financial situation, and consider consulting with a financial advisor to make the most informed decision about debt consolidation.

In summary, being proactive about understanding and managing the interest rate on your debt consolidation loans can lead to better financial outcomes and a path toward debt freedom.