Unlock Your Dream Home with No Closing Cost Mortgage Loans: A Comprehensive Guide

Guide or Summary:No Closing Cost Mortgage LoansWhat Are No Closing Cost Mortgage Loans?Benefits of No Closing Cost Mortgage LoansConsiderations When Choosin……

Guide or Summary:

- No Closing Cost Mortgage Loans

- What Are No Closing Cost Mortgage Loans?

- Benefits of No Closing Cost Mortgage Loans

- Considerations When Choosing No Closing Cost Mortgage Loans

- How to Qualify for No Closing Cost Mortgage Loans

No Closing Cost Mortgage Loans

In the world of real estate, financing your dream home can often come with a multitude of costs that can be overwhelming. One of the most significant expenses is the closing costs associated with securing a mortgage. However, the emergence of No Closing Cost Mortgage Loans has revolutionized the way homebuyers approach their financing options. These loans allow you to bypass the hefty closing fees typically associated with traditional mortgage options, making homeownership more accessible for many.

What Are No Closing Cost Mortgage Loans?

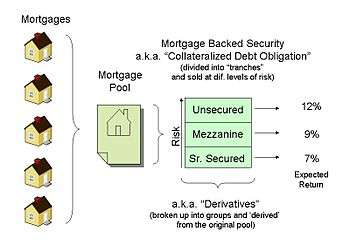

No closing cost mortgage loans are a type of mortgage that eliminates the upfront fees that are usually required at the closing of a real estate transaction. These costs can include appraisal fees, title insurance, attorney fees, and various other charges that can add up to thousands of dollars. Instead of paying these costs out of pocket, lenders often roll them into the loan amount or charge a slightly higher interest rate. This means that while you may pay more over the life of the loan, you can move into your new home without the immediate financial burden of closing costs.

Benefits of No Closing Cost Mortgage Loans

The primary advantage of No Closing Cost Mortgage Loans is the immediate financial relief they provide. For first-time homebuyers or those who may not have substantial savings, this option can make the difference between being able to purchase a home or having to delay their plans. Additionally, these loans can be particularly beneficial in a competitive housing market where buyers need to act quickly. By eliminating closing costs, buyers can close on a property faster and with less upfront cash.

Another significant benefit is the flexibility they offer. Homebuyers can choose to finance their closing costs over the life of the loan rather than paying them upfront. This can be especially appealing for those who prefer to keep their cash reserves intact for other expenses, such as home improvements or moving costs.

Considerations When Choosing No Closing Cost Mortgage Loans

While No Closing Cost Mortgage Loans offer many advantages, it is essential for potential borrowers to consider the long-term implications. By opting for a loan with no closing costs, borrowers may end up paying a higher interest rate. This means that over the life of the loan, they could pay significantly more in interest compared to a traditional mortgage where closing costs are paid upfront.

Additionally, it’s crucial to assess the total cost of the loan over its term. Homebuyers should use mortgage calculators to compare the overall expenses of different loan options and determine which is the most financially sound decision for their specific situation.

How to Qualify for No Closing Cost Mortgage Loans

Qualifying for No Closing Cost Mortgage Loans typically involves meeting the same criteria as traditional mortgage loans. Lenders will evaluate your credit score, income, debt-to-income ratio, and employment history. A strong credit profile can help you secure better terms, including lower interest rates, even with no closing costs.

Before committing to a no closing cost mortgage, it is advisable to shop around and compare offers from different lenders. Each lender may have varying terms and conditions, so it’s essential to find the one that best meets your financial needs.

In conclusion, No Closing Cost Mortgage Loans present an attractive option for many homebuyers looking to minimize their upfront expenses and ease the path to homeownership. While they come with their own set of considerations, the potential benefits can outweigh the drawbacks for those who carefully evaluate their options. By understanding these loans and how they work, you can make an informed decision that aligns with your financial goals and homeownership dreams. Whether you are a first-time buyer or looking to refinance, no closing cost mortgage loans could be the key to unlocking your new home.