Exploring Current VA Mortgage Loan Rates: What You Need to Know for 2023

#### Current VA Mortgage Loan RatesThe **current VA mortgage loan rates** are a critical factor for veterans and active-duty service members looking to fina……

#### Current VA Mortgage Loan Rates

The **current VA mortgage loan rates** are a critical factor for veterans and active-duty service members looking to finance their homes. The VA loan program, backed by the U.S. Department of Veterans Affairs, offers several advantages over conventional loans, including no down payment and no private mortgage insurance (PMI) requirements. Understanding the current rates is essential for making informed financial decisions.

#### Understanding VA Loans

VA loans are designed to provide affordable home financing options for those who have served in the military. The program aims to help veterans achieve homeownership by offering favorable loan terms. One of the key benefits is the ability to secure a mortgage without a down payment, which can significantly lower the barrier to entry for many service members and their families.

#### Factors Affecting Current VA Mortgage Loan Rates

Several factors influence the **current VA mortgage loan rates**. These include:

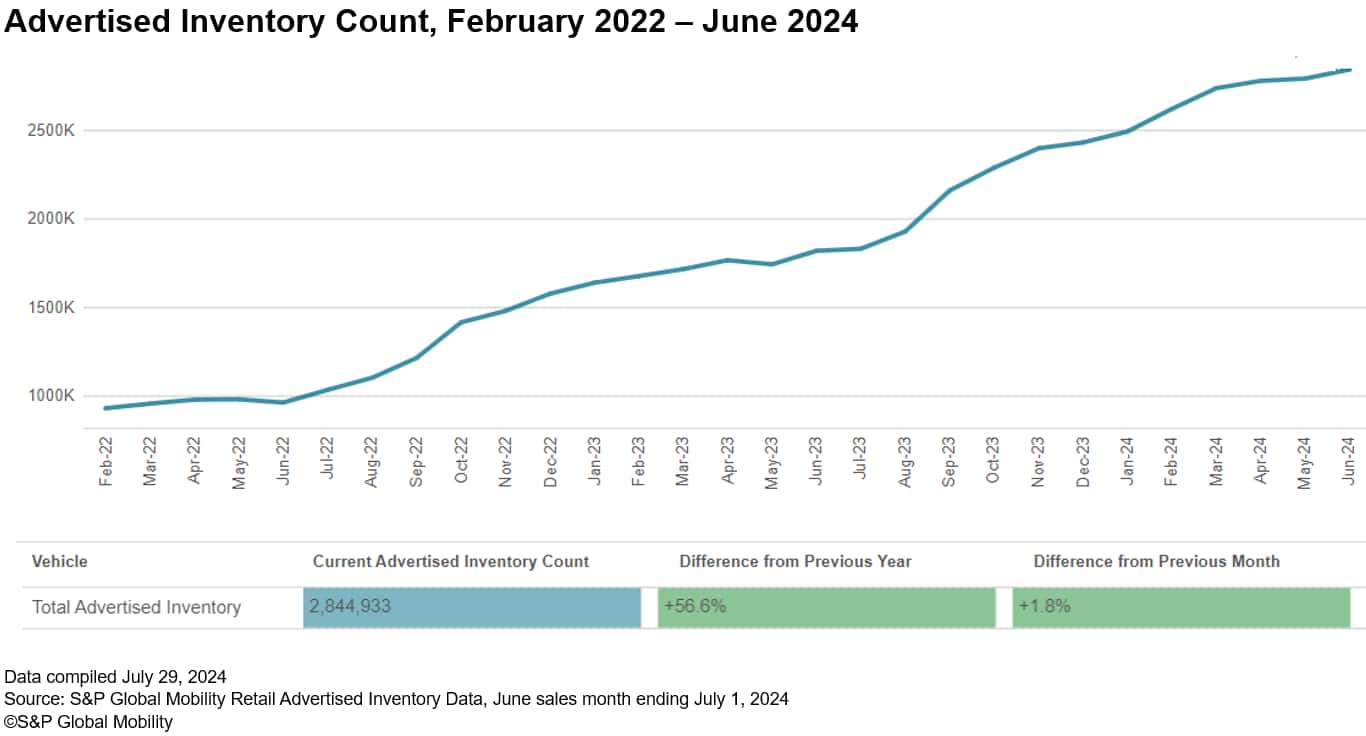

1. **Market Conditions**: Mortgage rates fluctuate based on the broader economic environment. When the economy is strong, rates may rise, while in a weaker economy, rates often decrease.

2. **Credit Score**: Borrowers with higher credit scores typically qualify for lower interest rates. It's essential for veterans to maintain a good credit score to take advantage of the best rates available.

3. **Loan Amount**: The size of the loan can also impact the interest rate. Larger loans might come with different rates compared to smaller loans.

4. **Lender Competition**: Different lenders may offer varying rates based on their own business strategies and competition in the market. It's advisable for borrowers to shop around and compare offers.

#### Benefits of Current VA Mortgage Loan Rates

The **current VA mortgage loan rates** provide several benefits to eligible borrowers:

- **No Down Payment**: This is one of the most significant advantages. Veterans can finance 100% of the home's value, making it easier to purchase a home without needing substantial savings.

- **Lower Interest Rates**: VA loans often come with lower interest rates compared to conventional loans. This can lead to substantial savings over the life of the loan.

- **No PMI**: Unlike conventional loans that require private mortgage insurance if the down payment is less than 20%, VA loans do not require PMI, reducing monthly payments.

- **Flexible Credit Requirements**: VA loans are more forgiving regarding credit scores, allowing more veterans to qualify for financing.

#### How to Secure the Best Current VA Mortgage Loan Rates

To secure the best **current VA mortgage loan rates**, consider the following tips:

1. **Improve Your Credit Score**: Before applying for a VA loan, check your credit report and take steps to improve your score if necessary. Pay down debts and ensure there are no errors on your report.

2. **Shop Around**: Don't settle for the first offer. Contact multiple lenders and compare their rates and terms. Some lenders may offer better deals than others.

3. **Consider the Loan Type**: VA loans come in various forms, including fixed-rate and adjustable-rate mortgages. Determine which type best suits your financial situation and risk tolerance.

4. **Get Pre-Approved**: Getting pre-approved for a loan can give you a better idea of the rates you qualify for and strengthen your position when making an offer on a home.

#### Conclusion

Staying informed about the **current VA mortgage loan rates** is crucial for veterans and service members looking to purchase a home. By understanding the factors that influence these rates and taking proactive steps to secure the best possible deal, borrowers can take full advantage of the benefits offered by the VA loan program. Whether you're a first-time homebuyer or looking to refinance, being knowledgeable about current rates can lead to significant savings and a smoother home-buying experience.