Discover the Best Easy Loan App for Quick Cash Solutions

Guide or Summary:Quick Application ProcessInstant ApprovalFlexible Loan AmountsTransparent Fees and Interest RatesSecure TransactionsAccessibilitySpeedImpro……

Guide or Summary:

- Quick Application Process

- Instant Approval

- Flexible Loan Amounts

- Transparent Fees and Interest Rates

- Secure Transactions

- Accessibility

- Speed

- Improved Financial Management

#### Introduction to Easy Loan App

In today's fast-paced world, financial emergencies can arise unexpectedly, leaving individuals in need of quick cash solutions. This is where the **easy loan app** comes into play. Designed to provide users with a hassle-free borrowing experience, these applications have gained immense popularity in recent years. With just a few taps on your smartphone, you can access funds to cover unexpected expenses, making the **easy loan app** a go-to solution for many.

#### What is an Easy Loan App?

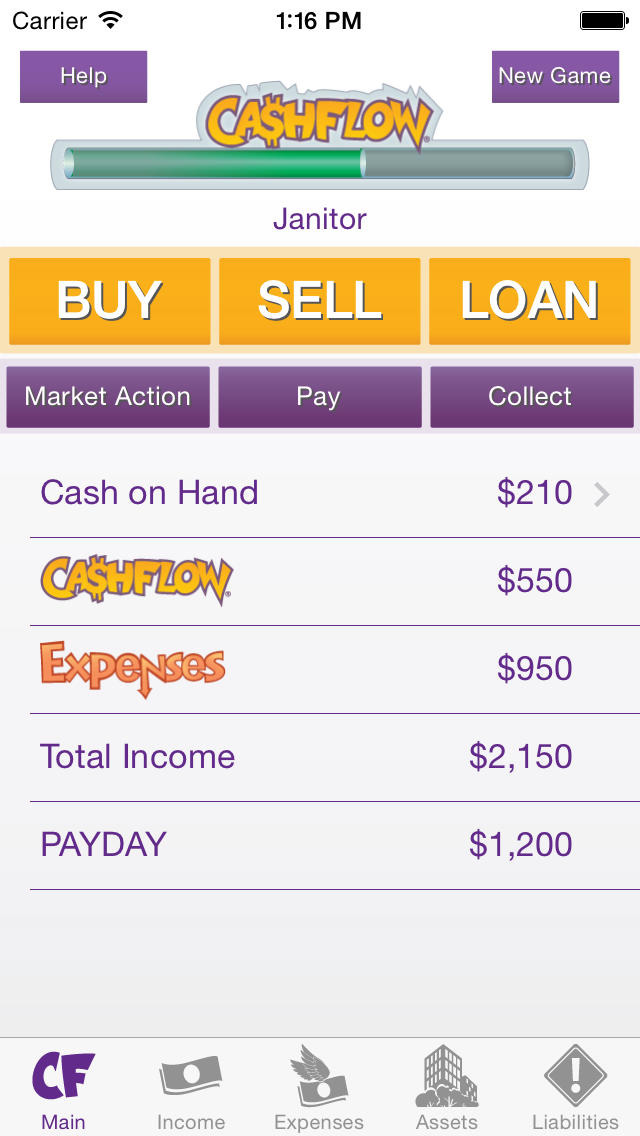

An **easy loan app** is a mobile application that allows users to apply for personal loans quickly and conveniently. Unlike traditional lending methods, which often require extensive paperwork and lengthy approval processes, easy loan apps streamline the borrowing experience. Users can apply for loans directly from their smartphones, receive instant approvals, and access funds within a short period.

#### Features of Easy Loan Apps

One of the main attractions of an **easy loan app** is its user-friendly interface. Most apps are designed with simplicity in mind, ensuring that even those who are not tech-savvy can navigate them with ease. Here are some common features of easy loan apps:

Quick Application Process

The application process for an easy loan app is typically straightforward. Users are required to fill out a short form with their personal and financial information. This often includes details such as income, employment status, and the amount they wish to borrow.

Instant Approval

Many easy loan apps offer instant approval, allowing users to know within minutes whether their loan application has been accepted. This rapid response time is crucial for individuals facing urgent financial needs.

Flexible Loan Amounts

Easy loan apps often provide a range of loan amounts, catering to various financial needs. Whether you require a small sum to cover a minor expense or a larger amount for significant costs, these apps can accommodate your requirements.

Transparent Fees and Interest Rates

Reputable easy loan apps are transparent about their fees and interest rates. Users can review these details before committing to a loan, ensuring they understand the total cost of borrowing.

Secure Transactions

Security is a top priority for easy loan apps. Most applications utilize advanced encryption technologies to protect users' personal and financial information, providing peace of mind while borrowing.

#### Benefits of Using an Easy Loan App

The convenience of an **easy loan app** cannot be overstated. Here are some benefits that make these apps a popular choice for borrowers:

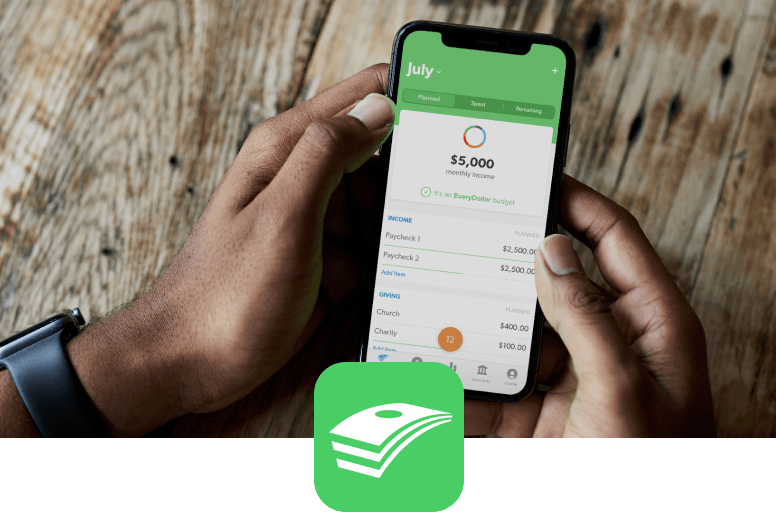

Accessibility

With an easy loan app, users can apply for loans anytime and anywhere. This level of accessibility is particularly beneficial for those who may not have the time to visit a bank or credit union during regular business hours.

Speed

The speed at which users can obtain funds is one of the most significant advantages of easy loan apps. Many applications allow users to receive money in their bank accounts within 24 hours of approval.

Improved Financial Management

Some easy loan apps come with budgeting tools and financial management features, helping users keep track of their expenses and manage their loans effectively.

#### Conclusion

In conclusion, the **easy loan app** has revolutionized the way individuals access funds in times of need. With their quick application processes, instant approvals, and user-friendly interfaces, these apps offer a viable solution for those seeking financial assistance. As technology continues to evolve, easy loan apps will likely become an even more integral part of personal finance management, providing users with the tools they need to navigate their financial journeys with confidence. Whether you're facing an unexpected expense or planning for a significant purchase, consider exploring the various easy loan apps available to find the best option for your needs.