Understanding A M Money Private Student Loan: Your Guide to Financing Education

#### A M Money Private Student LoanWhen it comes to financing your education, choosing the right loan is crucial. One option that many students consider is……

#### A M Money Private Student Loan

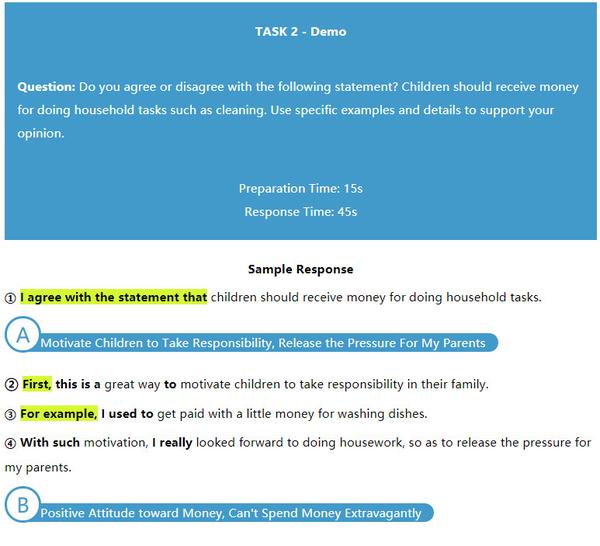

When it comes to financing your education, choosing the right loan is crucial. One option that many students consider is the A M Money Private Student Loan. This type of loan is designed to help students cover the costs of tuition, books, and living expenses while they pursue their academic goals. In this article, we will explore the features, benefits, and considerations of the A M Money Private Student Loan to help you make an informed decision.

#### What is A M Money Private Student Loan?

The A M Money Private Student Loan is a financial product offered by A M Money, aimed at students who need additional funding beyond federal student loans. Unlike federal loans, which have set interest rates and repayment terms, private student loans can vary significantly based on the lender, the borrower's credit history, and other factors. The A M Money Private Student Loan typically offers competitive interest rates and flexible repayment options, making it an attractive choice for many students.

#### Benefits of A M Money Private Student Loan

One of the primary advantages of the A M Money Private Student Loan is the potential for lower interest rates compared to other private loans. If you have a good credit score or a creditworthy co-signer, you may qualify for a lower rate, which can save you money over the life of the loan. Additionally, A M Money offers flexible repayment options, allowing borrowers to choose a plan that fits their financial situation. This can include interest-only payments while in school or a deferred payment option until graduation.

Another benefit is the possibility of borrowing a larger amount than federal loans typically allow. This can be particularly helpful for students attending expensive private colleges or those pursuing advanced degrees. The A M Money Private Student Loan can help bridge the gap between what federal loans cover and the total cost of education.

#### Considerations Before Applying

While the A M Money Private Student Loan has many benefits, there are also important considerations to keep in mind. First, private loans do not offer the same protections as federal loans. For instance, if you encounter financial difficulties, federal loans may offer deferment or forbearance options, whereas private loans may not. It’s essential to carefully review the terms and conditions of the A M Money Private Student Loan before committing.

Additionally, the interest rates on private loans can be variable, meaning they may increase over time. This variability can impact your monthly payments and the total cost of the loan. It is crucial to evaluate your financial situation and consider whether you can handle potential fluctuations in your payment amounts.

#### How to Apply for A M Money Private Student Loan

Applying for the A M Money Private Student Loan is a straightforward process. Students can typically apply online by providing personal information, details about their educational institution, and financial information. It’s advisable to have a co-signer if you have limited credit history, as this can improve your chances of approval and secure a better interest rate.

Once your application is submitted, A M Money will review your creditworthiness and financial situation. If approved, you will receive a loan offer outlining the terms, interest rate, and repayment options. Take the time to read this offer carefully and compare it with other loan options before making a decision.

#### Conclusion

In conclusion, the A M Money Private Student Loan can be a valuable resource for students seeking to finance their education. With competitive interest rates and flexible repayment options, it offers a viable alternative to federal loans. However, it is essential to weigh the benefits against the potential risks and to understand the terms of the loan fully. By doing your research and considering your financial situation, you can make an informed decision that supports your educational goals.