Exploring the Benefits and Risks of Alternative Loans for Your Financial Needs

Guide or Summary:Understanding Alternative LoansThe Benefits of Alternative LoansThe Risks InvolvedHow to Choose the Right Alternative Loan### Alternative L……

Guide or Summary:

- Understanding Alternative Loans

- The Benefits of Alternative Loans

- The Risks Involved

- How to Choose the Right Alternative Loan

### Alternative Loans (替代贷款)

In today's financial landscape, traditional lending institutions are not the only option available for individuals seeking funds. **Alternative loans** have emerged as a viable solution for many borrowers who may not qualify for conventional loans or who are looking for more flexible financing options. This article delves into the various aspects of alternative loans, including their benefits, risks, and how they can fit into your overall financial strategy.

Understanding Alternative Loans

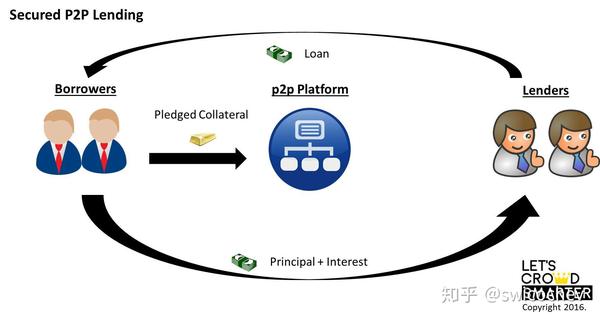

Alternative loans are financial products that differ from traditional bank loans. They can include peer-to-peer lending, payday loans, invoice financing, and even crowdfunding. These loans are often provided by non-traditional lenders, such as online platforms, credit unions, or private investors. The appeal of alternative loans lies in their accessibility and the speed at which funds can be obtained.

The Benefits of Alternative Loans

One of the primary advantages of alternative loans is their accessibility. Many alternative lenders have more lenient credit requirements compared to traditional banks, making it easier for individuals with less-than-perfect credit scores to secure financing. Additionally, the application process for alternative loans is often streamlined and can be completed online, resulting in quicker approval times and faster access to funds.

Another benefit is the variety of loan types available. Borrowers can choose from a range of options tailored to their specific needs, whether it's a small personal loan, business funding, or even a short-term cash advance. This flexibility allows borrowers to find a solution that best fits their financial situation.

The Risks Involved

Despite their advantages, alternative loans come with inherent risks. One of the most significant concerns is the cost. Many alternative lenders charge higher interest rates and fees compared to traditional banks, which can lead to a cycle of debt if borrowers are not careful. It is crucial for anyone considering an alternative loan to thoroughly read the terms and conditions and understand the total cost of borrowing.

Moreover, the lack of regulation in some alternative lending markets can expose borrowers to predatory lending practices. It is essential to research lenders and ensure they are reputable before committing to any loan agreement.

How to Choose the Right Alternative Loan

Choosing the right alternative loan requires careful consideration of your financial needs and circumstances. Start by assessing how much money you need and for what purpose. This will help you determine the type of alternative loan that best suits your needs.

Next, compare different lenders and their offerings. Look for transparency in the terms and conditions, including interest rates, fees, and repayment schedules. Reading reviews and seeking recommendations can also provide insights into the lender's reputation.

Finally, consider your ability to repay the loan. Create a budget that accounts for the loan payments and ensure that taking on additional debt will not jeopardize your financial stability.

In conclusion, alternative loans offer a range of options for borrowers who may not have access to traditional financing. While they can provide quick and flexible solutions, it is vital to approach them with caution. By understanding the benefits and risks associated with alternative loans, you can make informed decisions that align with your financial goals. Always do your due diligence and choose a reputable lender to ensure a positive borrowing experience.