Understanding the Impact of New Laws Regarding Student Loans on Borrowers and Future Students

#### New Laws Regarding Student LoansIn recent years, the landscape of student loans has been undergoing significant changes, with new regulations and refor……

#### New Laws Regarding Student Loans

In recent years, the landscape of student loans has been undergoing significant changes, with new regulations and reforms aimed at alleviating the financial burden on borrowers. The new laws regarding student loans are designed to address various issues, including rising tuition costs, repayment challenges, and the overall student debt crisis that affects millions of individuals across the United States.

#### The Purpose Behind the New Laws

The primary purpose of these new laws regarding student loans is to create a more equitable and manageable system for current and future students. With the total student loan debt exceeding $1.7 trillion, lawmakers have recognized the urgent need for reform. These laws aim to provide relief to borrowers, streamline the repayment process, and ensure that education remains accessible to all, regardless of financial background.

#### Key Features of the New Laws

One of the most notable features of the new laws regarding student loans is the introduction of income-driven repayment plans. Under these plans, borrowers will pay a percentage of their discretionary income towards their loans, making monthly payments more manageable. Additionally, there are provisions for loan forgiveness after a certain period of consistent payments, which can significantly reduce the long-term financial burden on borrowers.

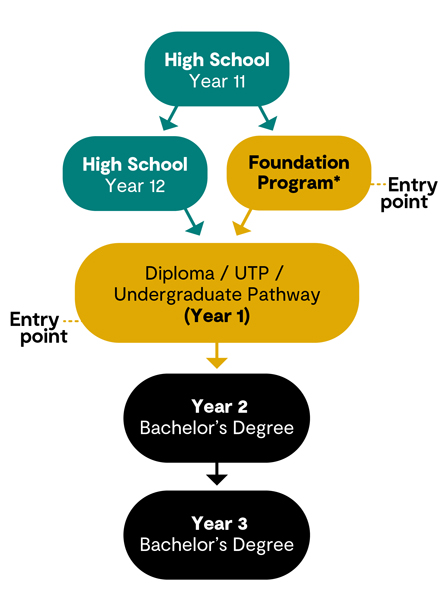

Another important aspect is the expansion of eligibility for federal student loan programs. The new laws regarding student loans aim to include more non-traditional students, such as those returning to education later in life or attending part-time. This inclusivity is essential in a rapidly changing job market where continuous learning is crucial for career advancement.

#### Implications for Borrowers

The implications of the new laws regarding student loans for borrowers are profound. Many individuals who have been struggling with high monthly payments may find relief through the newly implemented income-driven repayment options. Furthermore, the potential for loan forgiveness can provide hope for those who have felt overwhelmed by their debt.

For future students, these laws signify a shift towards a more supportive educational financing system. By making loans more accessible and manageable, the new laws regarding student loans encourage individuals to pursue higher education without the fear of insurmountable debt.

#### Challenges and Considerations

While the new laws regarding student loans present numerous benefits, there are also challenges and considerations to keep in mind. The implementation of these laws requires robust administrative support and clear communication to ensure that borrowers fully understand their options. Additionally, there may be concerns about the sustainability of these programs and their long-term impact on the federal budget.

Moreover, while the laws aim to provide relief, they do not address the root causes of rising tuition costs. Without a comprehensive approach to education funding, the cycle of debt may continue for future generations.

#### Conclusion

In conclusion, the new laws regarding student loans represent a significant step towards addressing the student debt crisis and making higher education more accessible. By focusing on income-driven repayment plans, loan forgiveness, and inclusivity, these laws aim to support borrowers and encourage educational pursuits. However, ongoing efforts are needed to ensure the long-term success of these reforms and to tackle the underlying issues of rising tuition costs and educational financing. As these laws take effect, it will be crucial for borrowers to stay informed and take advantage of the opportunities available to them.