"Unlock Financial Freedom with Same Day Loans for Bad Credit: Your Guide to Quick Cash Solutions"

#### Understanding Same Day Loans for Bad CreditSame day loans for bad credit are financial products designed to provide quick access to cash for individual……

#### Understanding Same Day Loans for Bad Credit

Same day loans for bad credit are financial products designed to provide quick access to cash for individuals with less-than-perfect credit histories. These loans are particularly appealing to those facing unexpected expenses, such as medical bills, car repairs, or urgent home repairs. Unlike traditional loans that often require a lengthy approval process and a good credit score, same day loans for bad credit can be approved within hours, making them a viable option for urgent financial needs.

#### The Benefits of Same Day Loans for Bad Credit

One of the primary advantages of same day loans for bad credit is the speed at which funds can be accessed. Borrowers can often receive their money on the same day they apply, which can be crucial in emergencies. Additionally, these loans typically have fewer eligibility requirements compared to conventional loans, allowing more people to qualify despite their credit challenges.

Another benefit is the flexibility these loans offer. Borrowers can use the funds for a variety of purposes, whether it’s to cover an unexpected bill or to manage cash flow until the next paycheck arrives. This versatility makes same day loans for bad credit an attractive option for those needing immediate financial relief.

#### How to Apply for Same Day Loans for Bad Credit

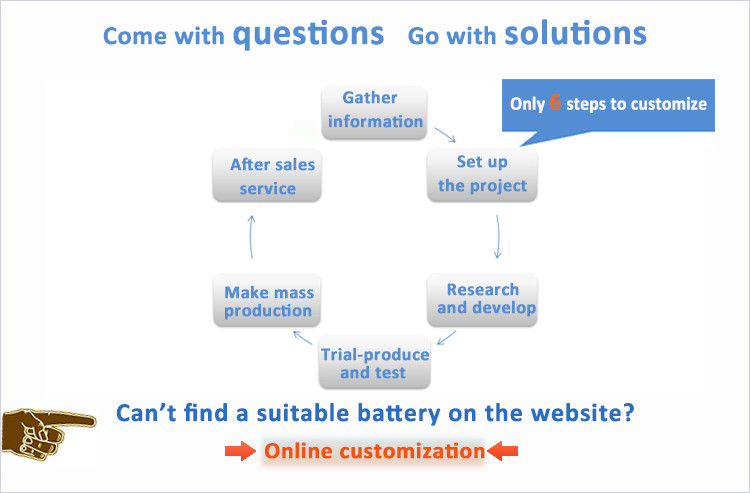

Applying for same day loans for bad credit is generally a straightforward process. Most lenders offer online applications that can be completed within minutes. Here’s a step-by-step guide on how to apply:

1. **Research Lenders**: Start by researching various lenders who offer same day loans for bad credit. Look for reputable companies with positive reviews and transparent terms.

2. **Check Eligibility**: Ensure you meet the basic eligibility requirements, which typically include being at least 18 years old, having a steady income, and a valid bank account.

3. **Complete the Application**: Fill out the online application form with your personal and financial information. Be honest about your credit situation, as lenders will assess your ability to repay the loan.

4. **Review Loan Offers**: After submitting your application, you may receive multiple loan offers. Review the terms, interest rates, and repayment schedules carefully before making a decision.

5. **Accept the Loan**: Once you find a suitable loan offer, accept it and provide any additional information the lender may require. If approved, the funds will typically be deposited into your bank account within hours.

#### Things to Consider Before Taking Out Same Day Loans for Bad Credit

While same day loans for bad credit can be a lifesaver in emergencies, they also come with certain risks. It’s essential to consider the following before proceeding:

- **Interest Rates**: These loans often have higher interest rates compared to traditional loans. Make sure you understand the total cost of borrowing and how it fits into your budget.

- **Repayment Terms**: Be clear about the repayment terms and ensure you can comfortably meet them. Missing payments can lead to additional fees and further damage to your credit.

- **Lender Reputation**: Only work with reputable lenders. Check for reviews and ratings to avoid predatory lending practices.

#### Conclusion: Making Informed Financial Decisions

Same day loans for bad credit can provide immediate financial relief when you need it most. However, it’s crucial to approach these loans with caution. By understanding the terms, evaluating your financial situation, and choosing a trustworthy lender, you can make an informed decision that helps you navigate your financial challenges effectively. Always consider exploring alternative options and ensure that you are not overextending yourself financially.