Understanding Check N Go Loans: Your Guide to Quick Financial Solutions

Guide or Summary:What Are Check N Go Loans?How Do Check N Go Loans Work?Advantages of Check N Go LoansRisks and ConsiderationsAlternatives to Check N Go Loa……

Guide or Summary:

- What Are Check N Go Loans?

- How Do Check N Go Loans Work?

- Advantages of Check N Go Loans

- Risks and Considerations

- Alternatives to Check N Go Loans

What Are Check N Go Loans?

Check N Go Loans, also known as payday loans, are short-term financial solutions designed to provide borrowers with quick access to cash. These loans are typically used by individuals who need immediate funds to cover unexpected expenses, such as medical bills, car repairs, or household emergencies. The process is straightforward: borrowers can apply online or in-store, and upon approval, they receive funds quickly, often within the same day.

How Do Check N Go Loans Work?

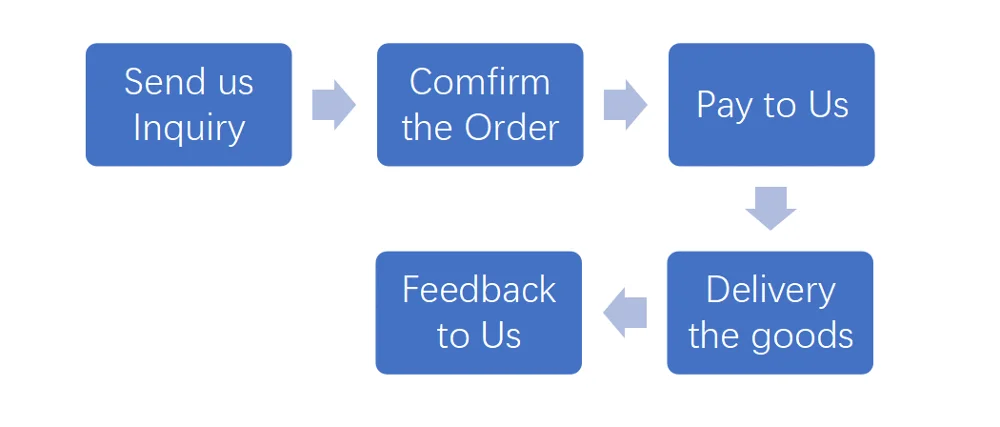

The mechanism of Check N Go Loans is relatively simple. Borrowers submit an application, which includes personal information, income details, and banking information. Lenders assess the application, and if approved, funds are deposited directly into the borrower's bank account. The loan amount usually ranges from a few hundred to a few thousand dollars, depending on the lender's policies and the borrower's financial situation.

Repayment terms for Check N Go Loans are typically short, often requiring the borrower to repay the loan in full by their next payday. This can be advantageous for those who need a quick fix, but it also means that borrowers must be cautious about their ability to repay the loan on time to avoid high-interest rates and potential fees.

Advantages of Check N Go Loans

One of the primary advantages of Check N Go Loans is the speed at which funds are made available. Unlike traditional loans that may take days or weeks to process, these loans can be approved and funded in a matter of hours. This makes them an appealing option for individuals facing urgent financial needs.

Additionally, Check N Go Loans often come with fewer qualification requirements compared to traditional bank loans. Many lenders do not require a credit check, making it easier for individuals with poor credit histories to access funds. This accessibility is particularly beneficial for those who may not have other financial options.

Risks and Considerations

While Check N Go Loans can provide quick financial relief, they also come with significant risks. The high-interest rates associated with these loans can lead to a cycle of debt if borrowers are unable to repay the loan on time. Failing to repay can result in additional fees, and the debt can quickly escalate.

Moreover, borrowers should be aware of the potential for predatory lending practices. It is crucial to research lenders thoroughly and understand the terms and conditions before agreeing to any loan. Reading reviews and checking for licensing can help ensure that borrowers are dealing with reputable lenders.

Alternatives to Check N Go Loans

For those who may be hesitant about taking out Check N Go Loans, there are alternatives available. Personal loans from credit unions or banks often have lower interest rates and longer repayment terms. Additionally, individuals can consider borrowing from friends or family, or exploring community resources that offer financial assistance.

Another option is to create a budget and seek ways to cut expenses temporarily. This can help alleviate the need for immediate cash and provide a more sustainable financial solution.

In summary, Check N Go Loans can be a valuable resource for individuals facing unexpected financial challenges. However, it is essential to approach these loans with caution and a clear understanding of the associated risks. By considering all available options and being informed about the terms of the loan, borrowers can make better financial decisions that align with their long-term goals.