"Maximizing Your Financial Aid: Strategies for Managing Student Loans in Summer"

#### Understanding Student Loans in SummerAs students transition into the summer months, the topic of student loans in summer becomes increasingly relevant……

#### Understanding Student Loans in Summer

As students transition into the summer months, the topic of student loans in summer becomes increasingly relevant. Many students take advantage of the summer break to work, intern, or enroll in summer courses, which can significantly impact their financial situation and loan obligations. Understanding how student loans in summer work is crucial for effective financial planning and management.

#### Types of Student Loans

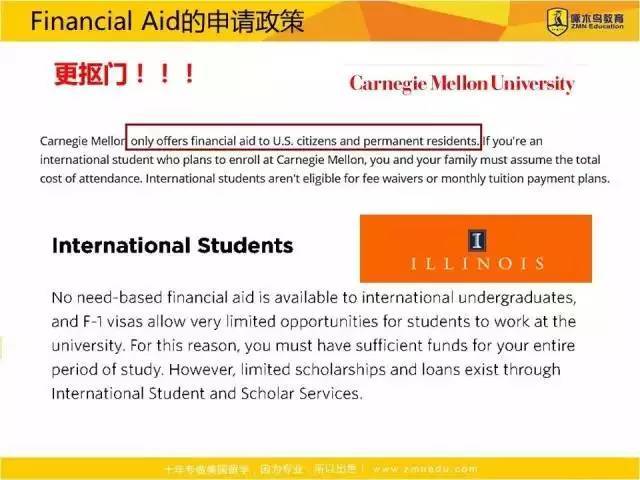

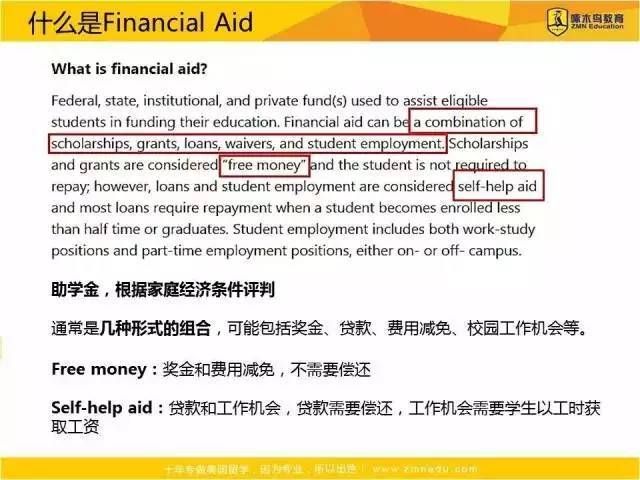

Before diving into strategies for managing student loans in summer, it's essential to understand the different types of student loans available. Federal loans, such as Direct Subsidized and Unsubsidized Loans, offer various benefits, including lower interest rates and flexible repayment options. Private loans, on the other hand, may come with higher interest rates and less favorable repayment terms. Knowing the differences can help students make informed decisions about their borrowing.

#### Impact of Summer Employment on Student Loans

One of the most effective ways to manage student loans in summer is through summer employment. Many students take on part-time or full-time jobs during the summer break, which can provide extra income to help pay down loans or cover living expenses. Earning money over the summer can help reduce the overall debt burden, especially if students are proactive about budgeting and saving.

#### Summer Courses and Financial Aid

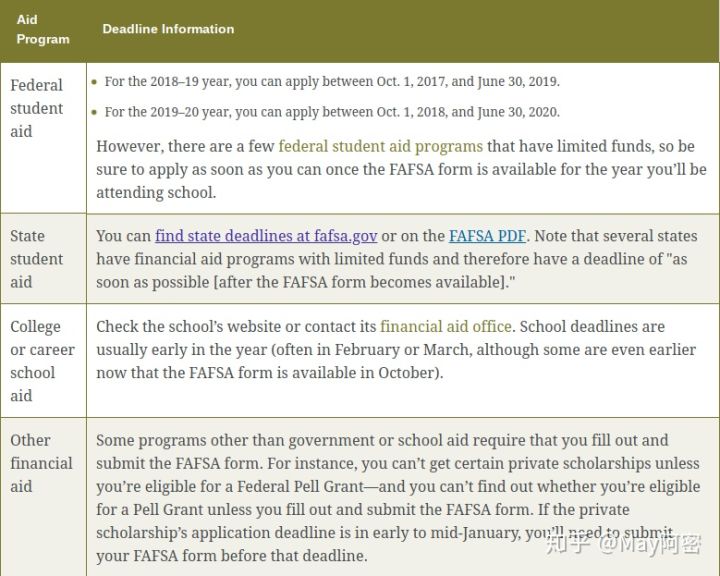

For some students, enrolling in summer courses can be a strategic move. Taking classes during the summer can accelerate graduation timelines, potentially reducing the total cost of education. However, it's crucial to understand how student loans in summer may be affected by additional coursework. Students should consult with their financial aid office to determine how summer enrollment impacts their financial aid package and loan eligibility.

#### Loan Repayment Options

Understanding loan repayment options is vital for managing student loans in summer. Students should familiarize themselves with the various repayment plans available, including Income-Driven Repayment (IDR) plans, which adjust monthly payments based on income. Additionally, students should consider the possibility of deferment or forbearance if they encounter financial difficulties during the summer months.

#### Budgeting for Summer Expenses

Creating a budget is an essential step in managing student loans in summer. Students should outline their expected income from summer jobs and estimate their living expenses, including rent, utilities, food, and transportation. By tracking spending and sticking to a budget, students can ensure they have enough funds to cover both their living costs and loan payments.

#### Long-Term Financial Planning

Finally, students should consider long-term financial planning when dealing with student loans in summer. This includes setting financial goals, such as saving for emergencies or planning for future loan payments after graduation. By thinking ahead, students can make informed decisions that will benefit their financial health in the long run.

In conclusion, managing student loans in summer requires careful consideration and planning. By understanding the types of loans available, exploring summer employment opportunities, and staying informed about repayment options, students can effectively navigate their financial responsibilities. Creating a budget and engaging in long-term financial planning will further empower students to take control of their financial futures.