Understanding Tax Benefits: Can I Deduct Student Loan Interest on My Taxes?

---#### Can I Deduct Student Loan Interest on My TaxesWhen it comes to financing your education, student loans are a common choice for many individuals. How……

---

#### Can I Deduct Student Loan Interest on My Taxes

When it comes to financing your education, student loans are a common choice for many individuals. However, as you navigate your financial responsibilities, you might wonder about the potential tax benefits associated with these loans. One of the most frequently asked questions is, **"Can I deduct student loan interest on my taxes?"** This inquiry is crucial for students and graduates alike, as understanding this deduction can lead to substantial savings during tax season.

#### What is the Student Loan Interest Deduction?

The student loan interest deduction allows eligible taxpayers to deduct interest paid on qualified student loans from their taxable income. This deduction can reduce your overall tax liability, making it an attractive option for those who are repaying student loans. The maximum deduction is up to $2,500 per year, depending on your income and filing status.

#### Eligibility Criteria

To qualify for the student loan interest deduction, you must meet several criteria:

1. **Qualified Student Loans**: The loan must have been taken out solely to pay for qualified education expenses for you, your spouse, or your dependents. This includes tuition, fees, room and board, and other necessary expenses.

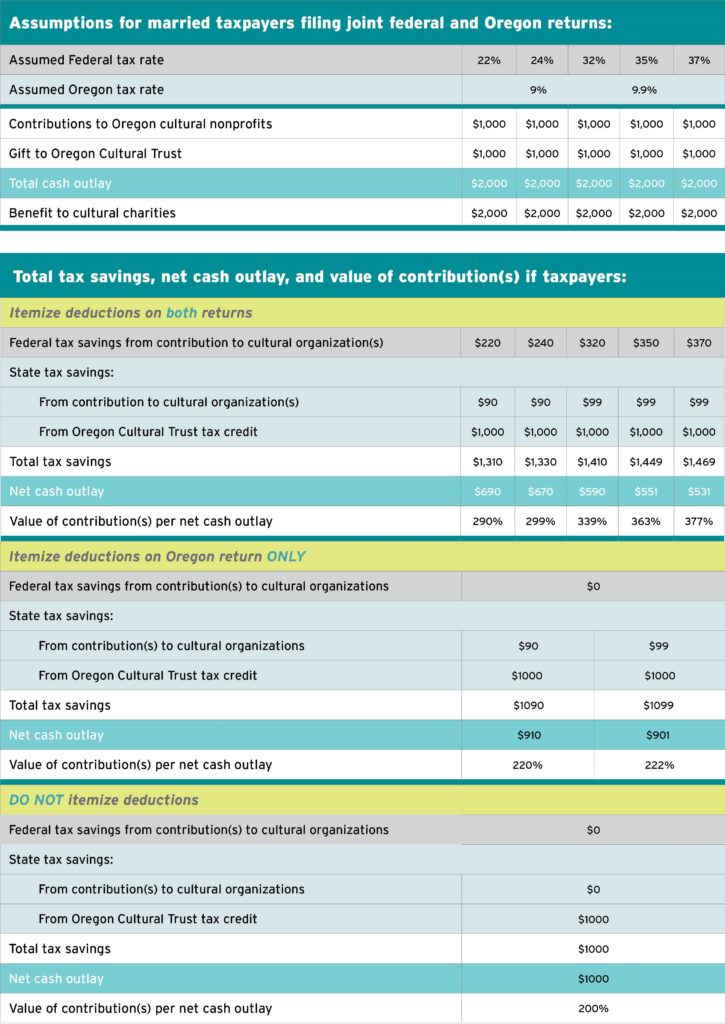

2. **Filing Status**: You cannot claim the deduction if you are married and file separately. To take advantage of this deduction, you must file as single, head of household, or married filing jointly.

3. **Income Limits**: Your modified adjusted gross income (MAGI) must be below a certain threshold. For 2023, the deduction begins to phase out for single filers with a MAGI of $70,000 and is completely phased out at $85,000. For married couples filing jointly, the phase-out starts at $140,000 and ends at $170,000.

4. **Loan Repayment**: You must have made interest payments on the student loan during the tax year for which you are claiming the deduction.

#### How to Claim the Deduction

Claiming the student loan interest deduction is relatively straightforward. You will need to report the interest you paid on your federal tax return using Form 1040. The amount of interest you can deduct will be indicated on Form 1098-E, which your loan servicer will send you if you paid $600 or more in interest during the year.

#### Benefits of the Deduction

The primary benefit of the student loan interest deduction is the potential for tax savings. By reducing your taxable income, you may lower your overall tax bill or increase your refund. This can provide much-needed financial relief, especially for recent graduates who may be facing the burden of student debt.

#### Conclusion

In summary, understanding whether **"Can I deduct student loan interest on my taxes?"** is vital for anyone repaying student loans. By meeting the eligibility criteria and properly claiming the deduction, you can take advantage of tax benefits that can ease your financial burden. Always consider consulting with a tax professional to ensure you are maximizing your deductions and navigating the complexities of tax law effectively. With the right knowledge and preparation, you can make informed decisions that positively impact your financial future.