Understanding Amortization Mortgage Loan: A Comprehensive Guide to Home Financing

#### What is Amortization Mortgage Loan?An **amortization mortgage loan** is a type of loan used to purchase real estate, where the borrower pays back the l……

#### What is Amortization Mortgage Loan?

An **amortization mortgage loan** is a type of loan used to purchase real estate, where the borrower pays back the loan amount along with interest over a specified period, typically 15 to 30 years. The term "amortization" refers to the gradual reduction of the loan balance through regular payments. Each payment includes both principal and interest, and over time, the portion of the payment that goes toward the principal increases while the interest portion decreases.

#### How Does Amortization Work?

In an **amortization mortgage loan**, the repayment structure is designed so that the borrower pays a fixed amount each month. This fixed payment includes both interest and principal, which means that borrowers can plan their finances more effectively. The amortization schedule outlines the breakdown of each payment, showing how much goes toward interest and how much reduces the principal balance.

For example, in the early years of the loan, a larger portion of the payment goes toward interest, while in the later years, more of the payment is applied to the principal. This structure can be beneficial for borrowers as it allows them to build equity in their home over time.

#### Benefits of Amortization Mortgage Loans

1. **Predictable Payments**: One of the main advantages of an **amortization mortgage loan** is that borrowers have predictable monthly payments. This stability makes it easier to budget and plan for future expenses.

2. **Equity Building**: As borrowers make payments over time, they gradually build equity in their home, which can be a valuable asset.

3. **Tax Benefits**: In many regions, the interest paid on mortgage loans is tax-deductible, providing potential savings for homeowners.

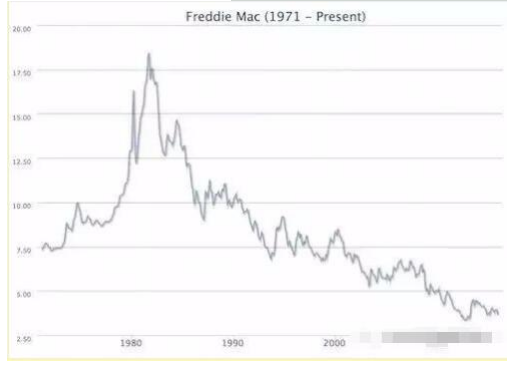

4. **Fixed Interest Rates**: Many amortization mortgage loans come with fixed interest rates, protecting borrowers from fluctuating market rates.

#### Types of Amortization Mortgage Loans

There are various types of **amortization mortgage loans**, including:

1. **Fixed-Rate Mortgages**: These loans have a constant interest rate and monthly payments that never change, making them ideal for long-term stability.

2. **Adjustable-Rate Mortgages (ARMs)**: These loans have interest rates that may change periodically, which can lead to lower initial payments but potential increases in the future.

3. **Interest-Only Mortgages**: In the initial years, borrowers only pay interest, which can lower monthly payments but does not build equity during that period.

#### How to Choose the Right Amortization Mortgage Loan

When selecting an **amortization mortgage loan**, consider the following factors:

1. **Loan Term**: Determine whether a 15-year or 30-year loan term is more suitable for your financial situation.

2. **Interest Rates**: Compare rates from different lenders to find the best deal.

3. **Fees and Closing Costs**: Be aware of any additional fees associated with the loan.

4. **Future Financial Goals**: Consider how the loan aligns with your long-term financial objectives.

#### Conclusion

Navigating the world of home financing can be complex, but understanding the concept of an **amortization mortgage loan** is a crucial first step. By knowing how these loans work, their benefits, and how to choose the right one, borrowers can make informed decisions that will impact their financial future. Whether you're a first-time homebuyer or looking to refinance, having a solid grasp of amortization will empower you to secure the best financing options available.