Student Loan Servicers List: Your Guide to Navigating the Labyrinth of Loan Management

Guide or Summary:Understanding Student Loan ServicersTop Student Loan Servicers: A Comprehensive ListChoosing the Right Student Loan ServicerIn the realm of……

Guide or Summary:

- Understanding Student Loan Servicers

- Top Student Loan Servicers: A Comprehensive List

- Choosing the Right Student Loan Servicer

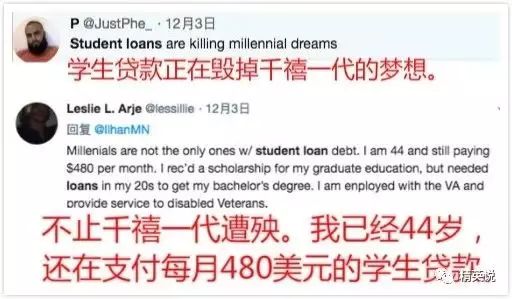

In the realm of higher education, the pursuit of academic excellence often comes with an accompanying heft of financial obligations. At the forefront of this financial landscape are student loan servicers, entities tasked with overseeing the repayment process of student loans. Amidst a pantheon of these organizations, it's crucial for borrowers to discern which loan servicer is best suited to their unique financial journey. This guide, tailored for those navigating the complexities of student loan servicing, delves into the list of reputable organizations, offering insights into their services, fees, and customer reviews. Armed with this knowledge, borrowers can make informed decisions, ensuring a smoother repayment process and a more secure financial future.

Understanding Student Loan Servicers

Student loan servicers act as intermediaries between borrowers and lenders, managing the repayment process, providing customer service, and offering various repayment plans to accommodate different financial scenarios. They handle the collection of payments, updates to account information, and even the processing of deferment and forbearance requests. A comprehensive understanding of these services is essential for borrowers looking to optimize their loan repayment strategy.

Top Student Loan Servicers: A Comprehensive List

A plethora of loan servicers vies for the trust of student loan borrowers. Here's a curated list of the most reputable organizations, each offering a unique blend of services and features:

1. **Federal Student Aid**: As the primary government entity overseeing federal student loans, Federal Student Aid provides a range of services, including processing loan applications, managing repayment plans, and offering resources for borrowers in default.

2. **Great Lakes Educational Loan Services**: With a reputation for excellent customer service, Great Lakes Educational Loan Services offers a variety of repayment options, including income-driven repayment plans, and provides resources to help borrowers manage their student loans effectively.

3. **PNC Student Loan Services**: Specializing in federal student loans, PNC Student Loan Services offers a user-friendly online platform, making it easy for borrowers to manage their loans and access repayment plans tailored to their income and family size.

4. **Nelnet**: Known for its innovative approach to loan servicing, Nelnet offers a wide array of repayment options, including income-driven repayment plans and deferment options. Their online portal provides borrowers with a comprehensive view of their loan accounts and repayment options.

5. **EduServ**: With a focus on customer service excellence, EduServ provides borrowers with a range of repayment options, including income-driven repayment plans, and offers resources to help borrowers navigate the complexities of student loan repayment.

6. **Troy Student Loan Servicing**: Specializing in federal student loans, Troy Student Loan Servicing offers a range of repayment options, including income-driven repayment plans, and provides resources to help borrowers manage their student loans effectively.

7. **Trans Union Consumer Solutions**: Known for its efficient loan processing and customer service, Trans Union Consumer Solutions offers a range of repayment options, including income-driven repayment plans, and provides resources to help borrowers navigate the complexities of student loan repayment.

Choosing the Right Student Loan Servicer

Selecting the right student loan servicer is a critical step in the loan repayment process. Factors to consider include the servicer's reputation, the range of repayment options offered, fees associated with loan servicing, and customer service quality. Borrowers should also evaluate the servicer's online portal and mobile app, as these tools can significantly impact the ease of managing their loans.

In conclusion, navigating the labyrinth of student loan servicing requires a strategic approach. By understanding the role of student loan servicers and exploring the list of reputable organizations, borrowers can make informed decisions that optimize their loan repayment strategy. With the right servicer by their side, borrowers can tackle their student loans with confidence, paving the way for a brighter financial future.