Discover the Benefits of Online Personal Loans Instant for Quick Financial Relief

#### Understanding Online Personal Loans InstantOnline personal loans instant refer to financial products that allow individuals to borrow money quickly thr……

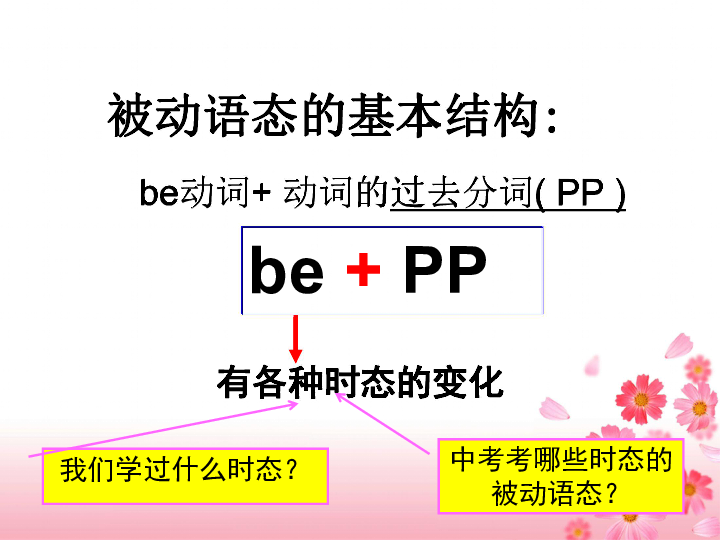

#### Understanding Online Personal Loans Instant

Online personal loans instant refer to financial products that allow individuals to borrow money quickly through online platforms. These loans are typically characterized by their fast approval processes and the ability to receive funds almost immediately after approval. Borrowers can apply for these loans without the need to visit a physical bank, making them a convenient option for those in urgent need of cash.

#### The Convenience of Online Applications

One of the primary advantages of online personal loans instant is the convenience of the application process. Borrowers can complete their applications from the comfort of their homes at any time of day or night. This eliminates the need for time-consuming appointments or waiting in long lines at traditional banks. Most online lenders offer user-friendly websites or mobile apps that guide borrowers through the application process step-by-step.

#### Fast Approval and Funding

Another significant benefit of online personal loans instant is the speed at which they are processed. Many online lenders utilize advanced algorithms and technology to assess applications quickly. In many cases, borrowers can receive approval within minutes, and once approved, funds can be deposited into their bank accounts as soon as the same day. This rapid turnaround is especially beneficial for individuals facing unexpected expenses, such as medical bills or car repairs.

#### Flexible Loan Amounts and Terms

Online personal loans instant often come with a range of loan amounts and repayment terms, allowing borrowers to select options that best fit their financial situations. Whether someone needs a small loan to cover a short-term expense or a larger amount for a more significant purchase, there are typically various options available. Additionally, many lenders offer flexible repayment plans, enabling borrowers to choose a schedule that aligns with their income and budget.

#### Improved Accessibility for Borrowers

Online personal loans instant have also improved accessibility for borrowers who may have difficulty obtaining loans through traditional means. Individuals with less-than-perfect credit scores or those who are self-employed may find it easier to secure funding from online lenders, as many of these platforms consider alternative data points when evaluating applications. This inclusivity helps more people access the funds they need for emergencies or personal projects.

#### Considerations Before Applying

While online personal loans instant offer many benefits, potential borrowers should also consider a few important factors before applying. Interest rates can vary significantly between lenders, so it’s crucial to compare offers to find the most favorable terms. Additionally, borrowers should be aware of any fees associated with the loan, such as origination fees or late payment penalties, which can impact the overall cost of borrowing.

#### Conclusion

In summary, online personal loans instant provide a fast, convenient, and accessible solution for individuals in need of immediate financial assistance. With the ability to apply online, receive quick approvals, and access funds rapidly, these loans can be a lifesaver in times of need. However, it is essential for borrowers to conduct thorough research and understand the terms of the loan before committing. By doing so, they can ensure that they make informed decisions that align with their financial goals.