Can 2 Friends Buy a House Together on Loan? Discover the Benefits and Challenges

Guide or Summary:The Benefits of Co-Buying a HomeUnderstanding the ChallengesLegal ConsiderationsWhen it comes to purchasing a home, many individuals may wo……

Guide or Summary:

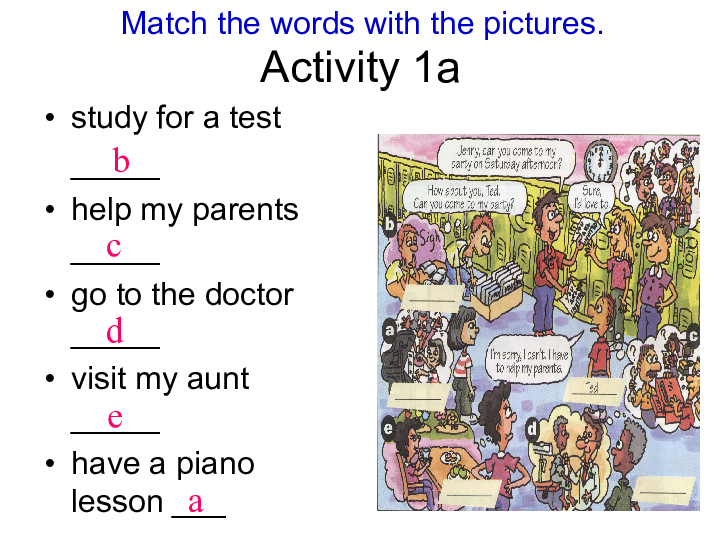

When it comes to purchasing a home, many individuals may wonder, can 2 friends buy a house together on loan? This question is becoming increasingly relevant in today’s housing market, where affordability can be a significant barrier for many potential homeowners. Teaming up with a friend to buy a property can open doors to homeownership that may otherwise remain closed. In this article, we will explore the various aspects of buying a house together, including the benefits, challenges, and essential considerations to keep in mind.

The Benefits of Co-Buying a Home

One of the most significant advantages of co-buying a home is the financial aspect. When two friends pool their resources, they can afford a larger down payment, which can lead to lower monthly mortgage payments. This collaborative effort can also allow for the purchase of a property in a more desirable location, which might be out of reach for an individual buyer. Additionally, sharing the financial responsibilities can ease the burden of homeownership, as both parties can contribute to mortgage payments, utility bills, and maintenance costs.

Another benefit of co-buying is the potential for building equity together. As property values increase over time, both friends can benefit from the appreciation of their investment. This can be a smart financial move, especially in a growing real estate market. Furthermore, if one friend is looking to build their credit score, co-signing on a mortgage can help improve their creditworthiness, provided that both parties manage the loan responsibly.

Understanding the Challenges

While the idea of co-buying a home with a friend is appealing, it is essential to understand the challenges that may arise. One of the primary concerns is the potential for disagreements. Different lifestyles, financial habits, and future plans can lead to conflicts over property management, maintenance responsibilities, and even the sale of the home. It is crucial for both parties to have open and honest discussions about their expectations and to establish a clear agreement outlining each person's responsibilities.

Another challenge is the financial implications of co-ownership. If one friend encounters financial difficulties, it can impact both parties. For example, if one person loses their job or faces unexpected expenses, they may struggle to make their share of the mortgage payments. This situation can lead to stress and strain on the relationship, making it essential to have a contingency plan in place.

Legal Considerations

Before embarking on the journey of co-buying a home, it is vital to seek legal advice. A real estate attorney can help draft a co-ownership agreement that outlines each person's rights and responsibilities, including what happens if one party wants to sell their share or if the relationship deteriorates. This document can serve as a safeguard, ensuring that both friends are protected and have a clear understanding of their arrangement.

Additionally, both friends should be aware of how their credit scores and financial histories will impact their ability to secure a mortgage. Lenders will evaluate both parties' creditworthiness, so it is essential to discuss finances openly and work towards improving credit scores if necessary.

In conclusion, the question of can 2 friends buy a house together on loan is not only feasible but can also be a rewarding experience for both parties involved. By understanding the benefits and challenges, establishing clear communication, and seeking legal advice, friends can navigate the complexities of co-buying a home successfully. With the right approach, this partnership can lead to a fulfilling and financially sound investment in real estate. Whether you are looking to share the joys of homeownership or simply want to make a smart financial decision, co-buying a home with a friend may be the perfect solution for you.