Loans: Your Ultimate Guide

Guide or Summary:What Are Cash Cow Title Loans?How Do Cash Cow Title Loans Work?Advantages of Cash Cow Title LoansTips for Securing the Best Cash Cow Title……

Guide or Summary:

- What Are Cash Cow Title Loans?

- How Do Cash Cow Title Loans Work?

- Advantages of Cash Cow Title Loans

- Tips for Securing the Best Cash Cow Title Loans

In today's fast-paced world, financial emergencies can arise unexpectedly, leaving individuals in need of quick cash solutions. One of the most effective ways to address these urgent needs is through **cash cow title loans**. This guide will delve into what cash cow title loans are, how they work, their advantages, and tips for securing the best deal.

What Are Cash Cow Title Loans?

**Cash cow title loans** are a type of secured loan where borrowers can use their vehicle's title as collateral. This means that if you own your car outright, you can leverage its value to access cash quickly. Unlike traditional loans that often require extensive credit checks and lengthy approval processes, cash cow title loans provide a more streamlined approach, allowing you to obtain funds in a matter of hours.

How Do Cash Cow Title Loans Work?

The process of obtaining a cash cow title loan is straightforward:

1. **Application**: Start by filling out an application form, which can often be done online. You'll need to provide details about your vehicle, including its make, model, year, and condition.

2. **Vehicle Inspection**: Lenders typically require a physical inspection of the vehicle to assess its value. This step is crucial as it determines how much money you can borrow.

3. **Loan Approval**: Once the inspection is complete, the lender will offer you a loan amount based on the vehicle's value. If you agree to the terms, you'll sign the loan agreement.

4. **Receive Funds**: After signing, you’ll receive the funds, often on the same day. The lender will keep the title of your vehicle until the loan is repaid.

5. **Repayment**: Cash cow title loans usually come with a repayment period ranging from 30 days to several months. It's essential to adhere to the repayment terms to avoid losing your vehicle.

Advantages of Cash Cow Title Loans

1. **Quick Access to Cash**: One of the most significant benefits of cash cow title loans is the speed at which you can obtain funds. This is particularly advantageous in emergencies.

2. **No Credit Check**: Many lenders do not require a credit check, making it easier for individuals with poor credit histories to qualify for a loan.

3. **Keep Your Vehicle**: Unlike some other types of loans, you can continue to drive your vehicle while repaying the loan, allowing you to maintain your daily routine.

4. **Flexible Use of Funds**: The money obtained from a cash cow title loan can be used for various purposes, including medical bills, home repairs, or unexpected expenses.

Tips for Securing the Best Cash Cow Title Loans

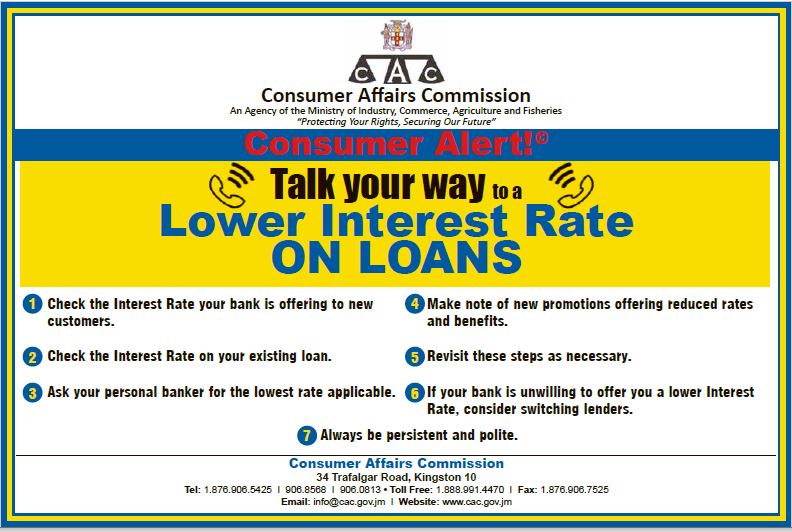

1. **Research Lenders**: Not all lenders are created equal. Take the time to compare interest rates, fees, and terms from different lenders to find the best deal.

2. **Understand the Terms**: Before signing any agreement, make sure you thoroughly understand the loan terms, including interest rates, repayment schedules, and any potential penalties for late payments.

3. **Assess Your Vehicle's Value**: Knowing your vehicle's worth can help you negotiate a better loan amount. Use online resources or consult with professionals if necessary.

4. **Plan for Repayment**: Ensure that you have a clear plan for repaying the loan to avoid any complications or loss of your vehicle.

In conclusion, **cash cow title loans** can be a valuable financial tool for those in need of quick cash. By understanding how they work and following best practices, borrowers can make informed decisions and navigate their financial challenges effectively. Whether it's covering unexpected expenses or managing cash flow, cash cow title loans offer a viable solution for many individuals.