Unlock Instant Cash with Car Cash Title Loans: Your Ultimate Guide to Fast Funding

#### Introduction to Car Cash Title LoansCar cash title loans are a type of secured loan that allows you to borrow money using your vehicle's title as colla……

#### Introduction to Car Cash Title Loans

Car cash title loans are a type of secured loan that allows you to borrow money using your vehicle's title as collateral. This means that if you own a car outright and have the title, you can leverage its value to obtain quick cash. These loans are ideal for those who need immediate funds for emergencies, bills, or unexpected expenses.

#### How Car Cash Title Loans Work

The process of obtaining a car cash title loan is relatively straightforward. First, borrowers must demonstrate that they own their vehicle and possess a clear title. Here’s a step-by-step breakdown of how it works:

1. **Application**: Start by filling out an application form online or at a local lender's office. You will need to provide details about your vehicle, including its make, model, year, and mileage.

2. **Vehicle Inspection**: Many lenders will require a physical inspection of the vehicle to assess its condition and determine its market value.

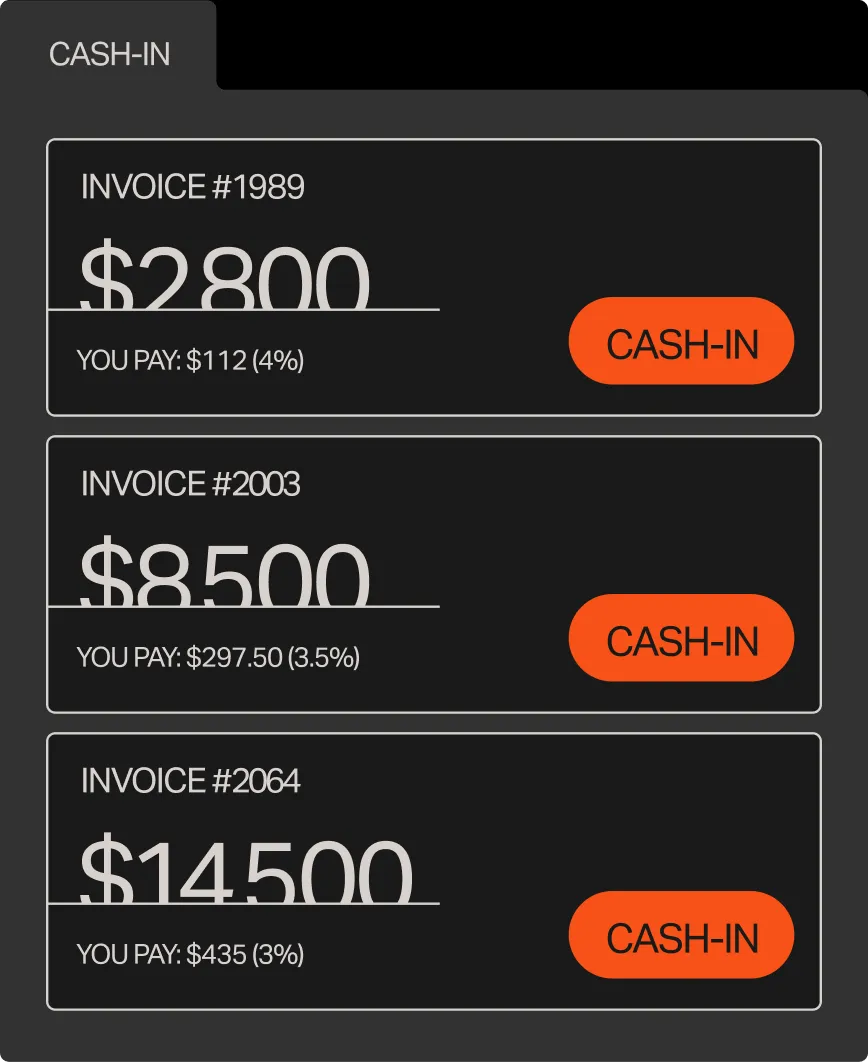

3. **Loan Offer**: Based on the vehicle's value, the lender will make a loan offer. Typically, you can borrow a percentage of the car’s value, often ranging from 25% to 50%.

4. **Documentation**: Once you accept the offer, you will need to provide necessary documentation, such as your ID, proof of income, and the vehicle title.

5. **Receiving Funds**: After all paperwork is completed, the lender will provide you with the cash, often on the same day.

#### Benefits of Car Cash Title Loans

Car cash title loans come with several advantages:

- **Quick Access to Funds**: Unlike traditional loans that can take days or weeks to process, title loans can often be approved within hours.

- **Flexible Use of Funds**: Borrowers can use the money for any purpose, whether it's paying medical bills, covering rent, or handling car repairs.

- **Keep Your Vehicle**: Unlike some other types of loans, you can continue to drive your car while repaying the loan, as long as you meet the repayment terms.

#### Considerations Before Applying for Car Cash Title Loans

While car cash title loans offer quick cash solutions, they also come with risks and considerations:

- **High Interest Rates**: Title loans typically have higher interest rates compared to traditional loans, which can lead to a cycle of debt if not managed properly.

- **Risk of Repossession**: Failing to repay the loan on time can result in the lender repossessing your vehicle.

- **Loan Terms**: It's essential to read the fine print and understand the terms of the loan, including repayment schedules and any fees involved.

#### Conclusion

Car cash title loans can be a viable option for individuals needing fast cash. However, it's crucial to approach them with caution and ensure that you fully understand the implications of borrowing against your vehicle. Always consider your financial situation and explore all available options before committing to a title loan. With the right approach, car cash title loans can provide the financial relief you need in a pinch.