Maximize Your Financial Planning: Discover the Benefits of the Plus Loan Calculator

Guide or Summary:Introduction to Plus Loan CalculatorWhat is a Plus Loan?How Does the Plus Loan Calculator Work?Benefits of Using the Plus Loan CalculatorUn……

Guide or Summary:

- Introduction to Plus Loan Calculator

- What is a Plus Loan?

- How Does the Plus Loan Calculator Work?

- Benefits of Using the Plus Loan Calculator

- Understanding Loan Repayment Options

- Planning for the Future with Plus Loan Calculator

- Conclusion: Empowering Your Financial Decisions

Introduction to Plus Loan Calculator

In today’s financial landscape, understanding your borrowing options is crucial. The **Plus Loan Calculator** is an essential tool that helps students and parents navigate the complexities of educational loans. This calculator provides a clear picture of potential loan amounts, interest rates, and repayment plans, making it easier to make informed decisions about financing education.

What is a Plus Loan?

A Plus Loan, or Parent Loan for Undergraduate Students, is a federal loan available to parents of dependent undergraduate students. It allows parents to borrow money to cover the cost of their child's education after other financial aid has been applied. The **Plus Loan Calculator** can help you estimate how much you can borrow and what your monthly payments might look like after graduation.

How Does the Plus Loan Calculator Work?

The **Plus Loan Calculator** works by taking into account several key factors. You’ll need to input the total cost of attendance for your child’s school, any financial aid they have received, and the interest rate of the loan. Once you enter this information, the calculator will provide an estimate of the monthly payments and the total amount you will repay over the life of the loan.

Benefits of Using the Plus Loan Calculator

Using the **Plus Loan Calculator** offers numerous benefits. Firstly, it allows you to visualize your financial commitment before you borrow. This foresight can help you make better decisions regarding how much to borrow and whether you can manage the repayment. Secondly, it helps you understand the impact of different interest rates on your loan, which can be particularly useful in comparing various loan options.

Understanding Loan Repayment Options

One of the most significant advantages of the **Plus Loan Calculator** is that it can help you understand various repayment options. Federal Plus Loans offer several repayment plans, including standard, graduated, and extended repayment plans. By using the calculator, you can see how each plan affects your monthly payments and total interest paid over time.

Planning for the Future with Plus Loan Calculator

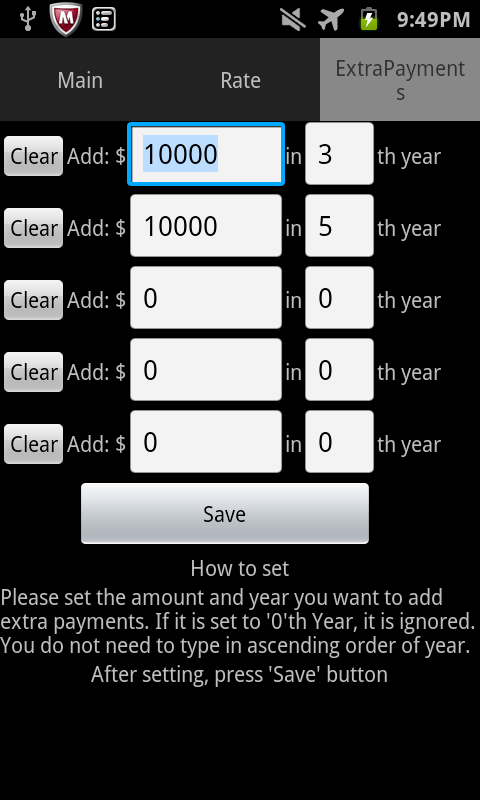

Planning for the future is essential when taking out a loan. The **Plus Loan Calculator** not only helps you estimate your monthly payments but also allows you to plan for potential changes in your financial situation. For example, if you anticipate a raise in your income or a change in your expenses, you can adjust your inputs in the calculator to see how these changes might affect your loan repayment.

Conclusion: Empowering Your Financial Decisions

In conclusion, the **Plus Loan Calculator** is a powerful tool that empowers parents and students to make informed financial decisions. By providing a clear understanding of loan amounts, interest rates, and repayment plans, this calculator can significantly ease the stress associated with financing education. Whether you are a parent looking to support your child’s education or a student exploring your options, utilizing the **Plus Loan Calculator** can lead to smarter financial planning and a more secure future.