Discover the Best Service Loan Options in Henderson, TX: Your Comprehensive Guide to Financial Assistance

#### Service Loan Henderson TXIf you are in need of financial assistance in Henderson, TX, understanding your options for a service loan is crucial. A servi……

#### Service Loan Henderson TX

If you are in need of financial assistance in Henderson, TX, understanding your options for a service loan is crucial. A service loan, often referred to as a personal loan or a small business loan, can provide you with the funds necessary to meet your immediate financial needs. Whether you are facing unexpected expenses, planning a major purchase, or looking to consolidate debt, a service loan can be a viable solution.

#### Understanding Service Loans

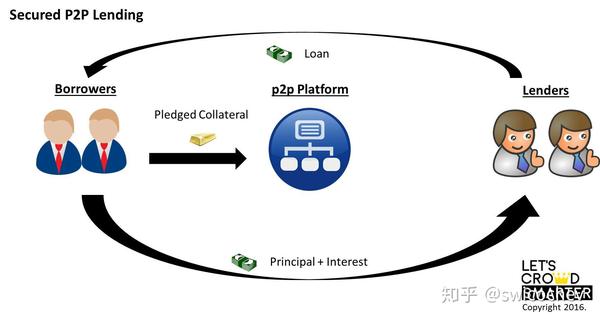

A service loan is a type of financing that allows individuals or businesses to borrow money for various purposes. These loans can be secured or unsecured, depending on whether you provide collateral. In Henderson, TX, many lenders offer service loans with competitive interest rates and flexible repayment terms. It’s essential to shop around and compare different loan options to find the best fit for your financial situation.

#### Types of Service Loans Available in Henderson, TX

In Henderson, TX, you can find several types of service loans:

1. **Personal Loans**: These loans are typically unsecured and can be used for various purposes, such as medical expenses, home improvements, or debt consolidation. Personal loans usually have fixed interest rates and a set repayment period.

2. **Business Loans**: If you own a business or are looking to start one, a service loan can help you secure the necessary funds to cover operational costs, purchase inventory, or expand your business. Business loans may require a business plan and financial statements.

3. **Payday Loans**: These are short-term loans designed to cover urgent expenses until your next paycheck. While they may be easy to obtain, they often come with high-interest rates and should be approached with caution.

4. **Title Loans**: If you have a vehicle, you can use it as collateral for a title loan. This type of loan allows you to borrow a percentage of your vehicle’s value while still being able to drive it.

#### How to Apply for a Service Loan in Henderson, TX

Applying for a service loan in Henderson, TX, is a straightforward process. Here are the steps you can follow:

1. **Assess Your Financial Needs**: Determine how much money you need and what you will use it for. This will help you choose the right type of loan.

2. **Check Your Credit Score**: Your credit score will play a significant role in your ability to secure a loan and the interest rates you’ll be offered. Check your credit report for any errors and take steps to improve your score if necessary.

3. **Research Lenders**: Look for lenders in Henderson, TX, that offer service loans. Compare interest rates, fees, and terms to find the best option for you.

4. **Gather Necessary Documentation**: Lenders will typically require documentation such as proof of income, identification, and information about your financial history.

5. **Submit Your Application**: Once you have chosen a lender, complete the application process, providing all required information and documentation.

6. **Review Loan Terms**: If approved, carefully review the loan terms before signing. Ensure you understand the interest rate, repayment schedule, and any fees associated with the loan.

#### Benefits of Service Loans in Henderson, TX

Service loans offer several benefits, including:

- **Quick Access to Funds**: Many lenders provide fast approval and funding, allowing you to address urgent financial needs promptly.

- **Flexible Use**: Unlike some loans that are designated for specific purposes, service loans can be used for a variety of needs.

- **Build Credit**: Successfully repaying a service loan can help improve your credit score, making it easier to obtain financing in the future.

In conclusion, if you are considering a service loan in Henderson, TX, it is essential to understand your options and choose a loan that fits your financial needs. By following the steps outlined above and being informed about the types of loans available, you can make a well-informed decision that supports your financial goals.