Exploring the Current Auto Loan Rates in California: What You Need to Know

#### Current Auto Loan Rates CaliforniaWhen it comes to financing a vehicle, understanding the current auto loan rates California is crucial for making info……

#### Current Auto Loan Rates California

When it comes to financing a vehicle, understanding the current auto loan rates California is crucial for making informed decisions. Whether you're looking to buy a new car or refinance an existing loan, having a grasp of the prevailing interest rates can significantly impact your monthly payments and overall financial health.

#### Understanding Auto Loan Rates

Auto loan rates fluctuate based on various factors, including economic conditions, the borrower's credit score, the loan term, and the lender's policies. In California, the current auto loan rates California can vary widely depending on these factors. Generally, borrowers with excellent credit can secure lower interest rates, while those with poor credit may face higher rates.

It's essential to shop around and compare rates from different lenders, including banks, credit unions, and online lenders. Many financial institutions offer competitive rates, and even a slight difference in interest can lead to substantial savings over the life of the loan.

#### Factors Influencing Auto Loan Rates

Several key factors influence the current auto loan rates California:

1. **Credit Score**: Your credit score plays a significant role in determining the interest rate you'll receive. Lenders view higher credit scores as indicators of responsible borrowing, which often translates to lower rates.

2. **Loan Term**: The length of the loan can also affect the interest rate. Typically, shorter loan terms come with lower rates, while longer terms may lead to higher rates due to increased risk for the lender.

3. **Vehicle Type**: New cars often come with lower interest rates compared to used cars. This is because new vehicles have a higher resale value, making them less risky for lenders.

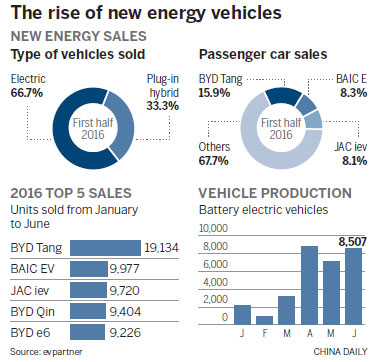

4. **Market Conditions**: Economic factors, such as inflation and the Federal Reserve's interest rate policies, can influence auto loan rates. Keeping an eye on these trends can help you time your loan application for the best possible rate.

#### Finding the Best Auto Loan Rates

To find the best current auto loan rates California, consider the following steps:

- **Check Your Credit Report**: Before applying for a loan, review your credit report for any errors or discrepancies. Addressing these issues can improve your credit score and potentially lower your interest rate.

- **Get Pre-Approved**: Many lenders offer pre-approval, which gives you a better idea of the rates you can expect. This process involves a soft credit inquiry and can help you compare offers more effectively.

- **Negotiate**: Don't hesitate to negotiate the terms of your loan. Some lenders may be willing to lower their rates or offer better terms to secure your business.

- **Consider a Co-Signer**: If your credit score is less than stellar, having a co-signer with good credit can help you secure a better rate.

#### Conclusion

In summary, understanding the current auto loan rates California is essential for anyone looking to finance a vehicle. By considering factors such as credit score, loan term, and market conditions, you can make informed decisions that will benefit your financial future. Always take the time to shop around, compare rates, and negotiate terms to ensure you get the best deal possible. Whether you're purchasing a new car or refinancing an existing loan, staying informed about current rates will empower you to make the best financial choices.